boulder co sales tax return form

CLAIM FOR REFUND OF BOULDER TAX. Boulder co sales tax return form Wednesday March 9 2022 Edit The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax.

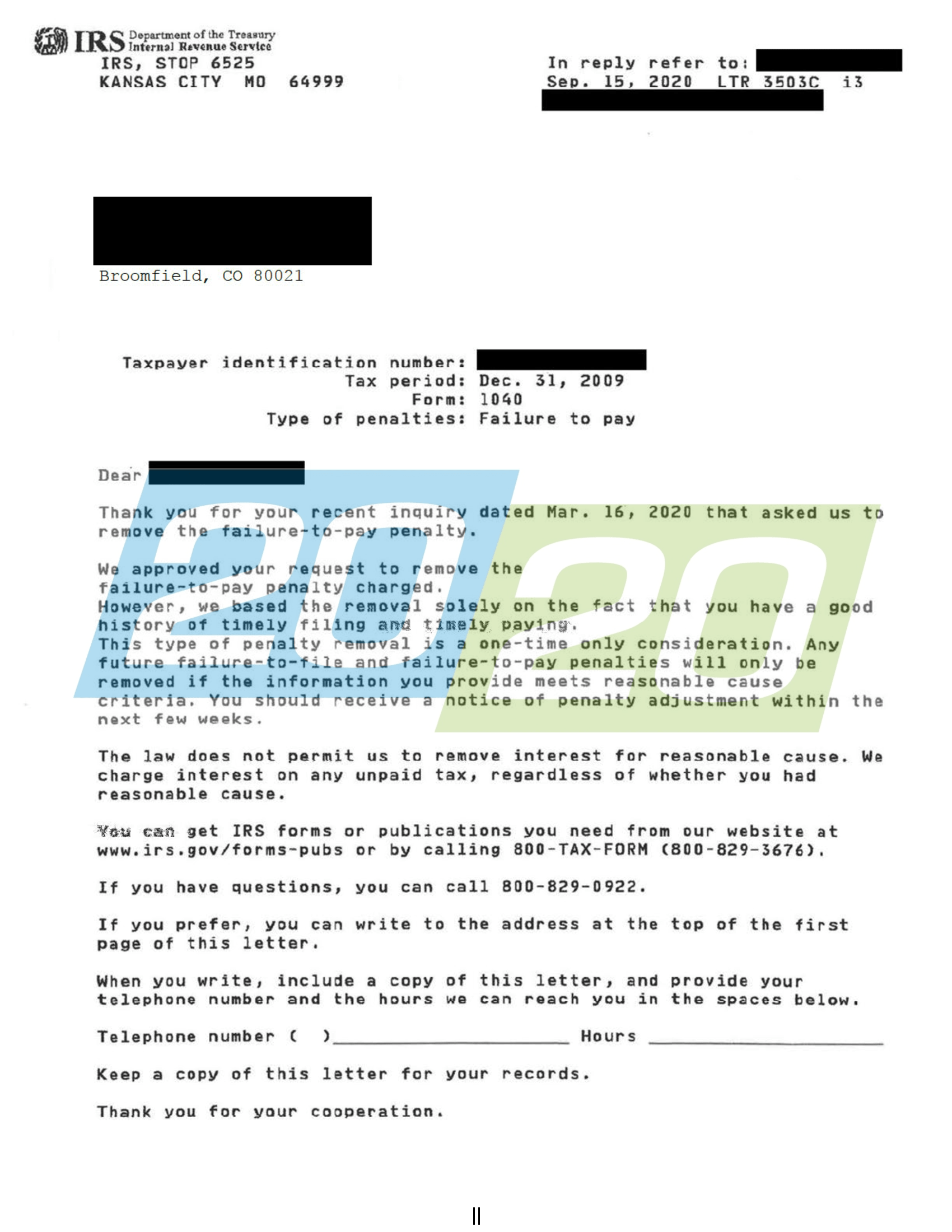

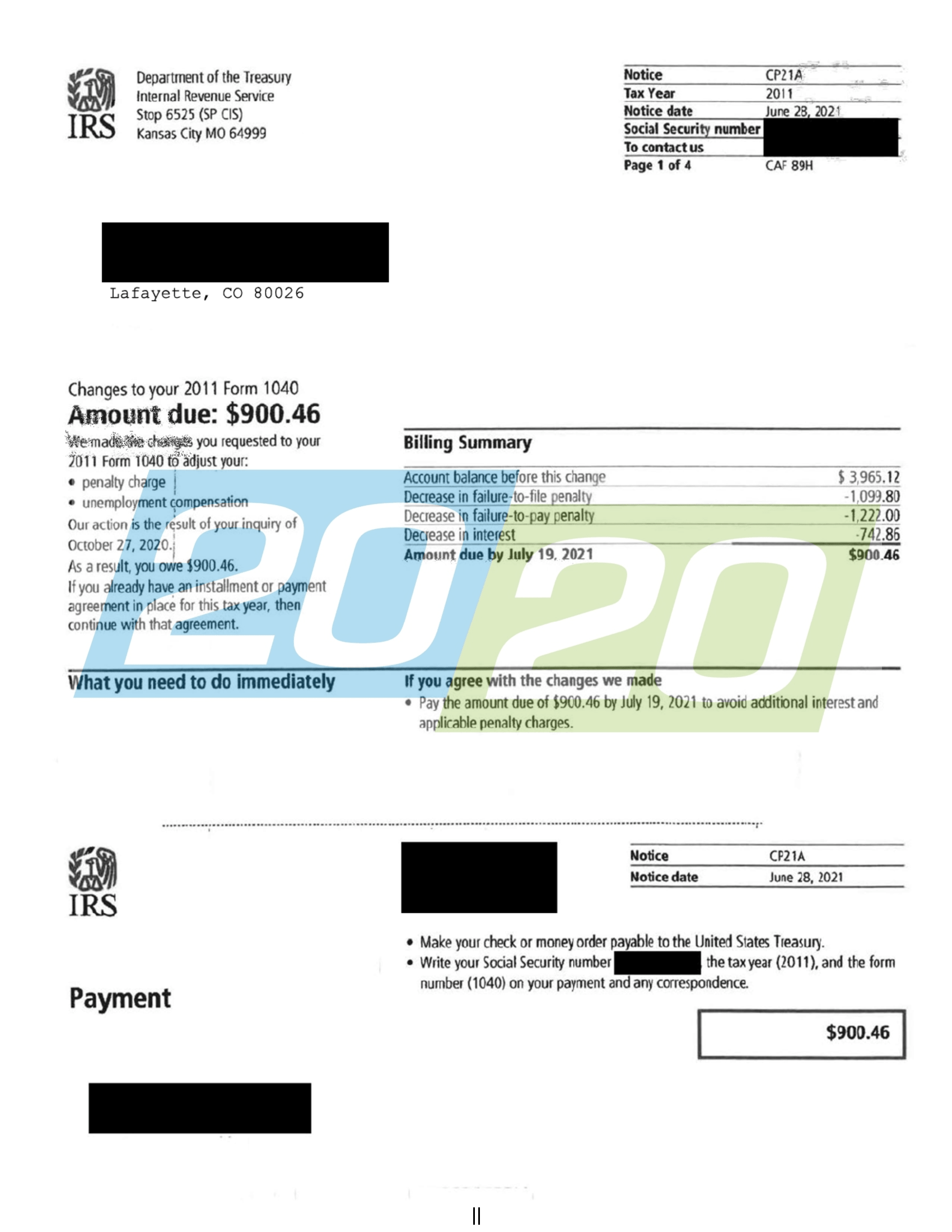

Tax Resolutions In Colorado 20 20 Tax Resolution

Form 104 and Booklet.

. Httpsbouldercoloradogovtax-licensesales-and-use-tax for more information on tax and licensing including tax rates tax guidance and FAQs. About City of Boulders Sales and Use Tax. For tax year 2019 and later you will no longer use form 1040-A or 1040-EZ but instead use the redesigned Form 1040.

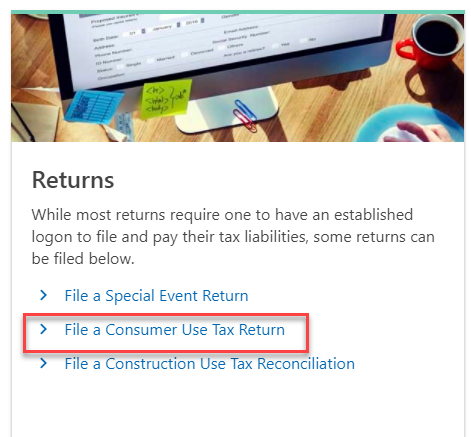

Sales tax returns are due the 20th of the month following the month reported. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. All payments of Boulder County sales tax should be reported through CDORs Revenue Online portal or through forms found at wwwcoloradogovrevenue.

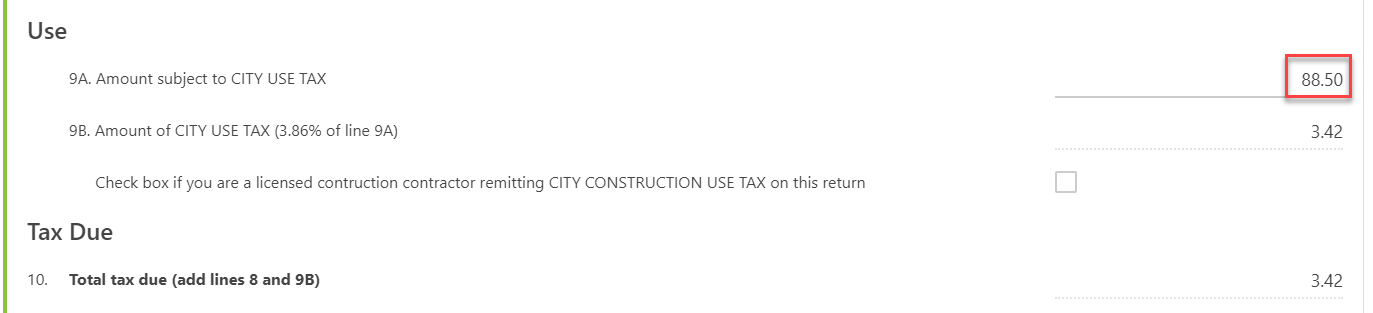

File Sales Tax Online Department of Revenue - Taxation. SALES TAX RETURN You must file this return even if line 15 is zero Note. This is the total of state county and city sales tax rates.

For questions about city taxes and. If you need additional assistance please call 303-441-3050 or e-mail us at. A tax return must be filed even if there is no tax due.

Information about City of Boulder Sales and Use Tax. BOX 791 BOULDER CO 80306 303441- 3288. Longmont 515 Coffman Street Suite 114 Mondays ONLY Hours.

DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. The minimum combined 2022 sales tax rate for Boulder Colorado is. 2021 Colorado Forms.

Fishl1 Created Date. Boulder 1325 Pearl Street 2nd floor Boulder CO 80302 Mondays thru Thursdays Hours. DR 0154 - Sales Tax Return for Occasional Sales.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. Did South Dakota v. Boulder Online Tax System.

File Sales Tax Online. Sales tax returns are due the 20th of the month following the month reported. Paper Filing Taxpayers that choose to file tax returns by printing the form generated through Boulder Online Tax and personally deliver or mail with payment.

Subcontractor Affidavit Page 2 1777 BROADWAY PO. The Boulder sales tax rate is. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions.

Publication 32 titled gifts premiums and prizes states purchases of tangible personal property for use as gifts premiums or. Additional Forms Instructions. Broomfield CO 80038-0407 FILING PERIOD Required Returns not postmarked by the due date will be late CITY COUNTY OF BROOMFIELD Sales Tax Administration Division PO.

730 am5 pm Map Directions. What is the sales tax rate in Boulder Colorado. 730 am430 pm Map Directions.

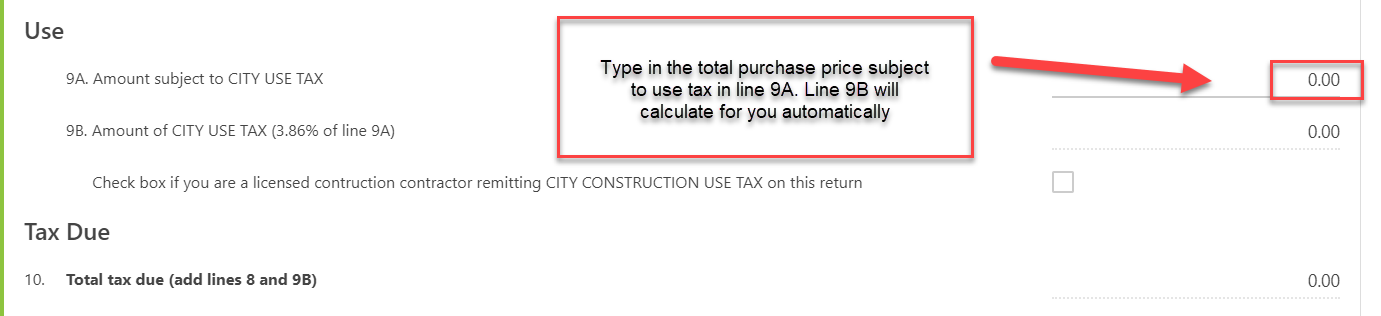

FID Taxable sales times 01 0001. Valid returns are those generated by Boulder Online Tax and will include a media. Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment Declaration to determine the use tax that may be owed to the City.

City Sales Tax _____ Date return was filedtax paid _____ Reporting period _____ to _____ Type of Tax _____ Reason for Refund IWe declare under the penalties of perjury that this claim including any accompanying schedules and statements has been. CR 0100AP - Business Application for Sales Tax Account. Box 407-Taxable sales times 2 002 a Flatiron Improv.

DR 0100 - Retail Sales Tax Return Supplemental Instructions DR 0103 - State Service Fee Worksheet. Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides. Lafayette 1376 Miners Drive Unit 105 Tuesdays ONLY Hours.

The County sales tax rate is. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations.

Wayfair Inc affect Colorado. The library does not carry paper tax forms but staff are happy to assist with downloading and printing forms and instructions. Navigating the Boulder Online Tax System.

The city of boulder requires all organizations and businesses coming into boulder for special events to obtain a city of boulder business license and file a sales use tax return. There are a few ways to e-file sales tax returns. DR 0235 - Request for Vending Machine Decals.

Assessor Boulder Longmont Drop Boxes. All payments of Boulder County sales tax should be reported through CDORs Revenue Online or through CDORs printable forms found at CDORs website. Boulder co sales tax return form.

See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Boulder CO. 730 am5 pm Map Directions. Para asistencia en español favor de mandarnos un email a.

The Colorado sales tax rate is currently. If you have more than one business location you must file a separate return in Revenue Online for each location. Salestaxbouldercoloradogov o llamarnos a 303-441-4425.

Tenant Receipt Of Key S Ez Landlord Forms Lettering Being A Landlord Reference Letter

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

Sales And Use Tax City Of Boulder

Tax Rates Org The Tax Information Portal Tax Forms Property Tax Income Tax

Sales Tax Boulder Form Fill Out And Sign Printable Pdf Template Signnow

Pin By University Of Colorado Boulder On Resume And Cover Letter Tips Cover Letter Tips Get Reading Job Information

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Campus Controller S Office University Of Colorado Boulder

The Best Places To Retire In 2021 In 2022 Best Places To Retire Retirement The Good Place

Sales Tax Campus Controller S Office University Of Colorado Boulder